Part 2 The fightback begins - Part

3 Return of the Mac - Results and table

Administration and aftermath - The

Chronology

On 8 May 2001, Leeds United were in Valencia's Mestalla Stadium tilting

at a place in the Champions' League final. Six years later the club was

relegated to the third tier of English football for the first time and

pitched into the maelstrom of financial administration; it was an astonishing

fall from grace.

At the end of a disastrous 2006/07

season, failure to beat Ipswich Town at Elland Road on 28

April had all but confirmed relegation. United had a game still

to play, but the vast inferiority of their goal difference made

the task of overtaking Hull City, even if they could eradicate

the three-point gap, a remote mathematical possibility.

With the club's financial position brittle to say the least,

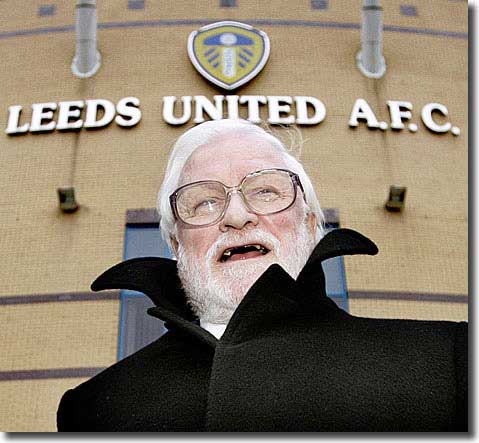

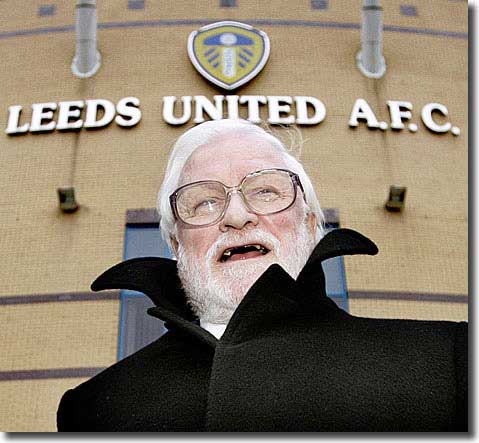

United chairman Ken Bates saw his opportunity and the club opened

feverish discussions with the accountants, KPMG. By 4 May Leeds

United had been placed in administration and the business and

assets sold to Leeds United Football Club Limited, a new company

set up by Bates and his fellow directors.

The move smacked of opportunist manipulation, with the resultant 10-point

penalty an irrelevance that served merely to formally confirm the inevitable

relegation. The numerous enemies that Bates had made over the years were

beside themselves with righteous indignation, but the man himself was

bullishly unrepentant, snapping, 'People in Leeds tell me they need a

successful club. Well they need to get off their backsides and come and

support the club. Show us your money. When we're back where we belong,

we'll remember the people who did support us and those who didn't support

us. Revenge will be a dish best eaten cold.'

At the end of March, the club's balance sheet groaned under debts

of £35m, with a cash injection of £10m required to continue trading.

This position made administration inevitable, and provided the

club with an opportunity to develop a Company Voluntary Arrangement

(CVA), a legal procedure defined under the Insolvency Act, which

enables a company to settle its debts at a discounted rate, and

requires the approval of 75% of the voting creditors. The Football

League insists on a CVA as the only acceptable means for a club

to exit administration if it wishes to retain its League membership.

With Bates confidently claiming to have 75% of votes in the bag,

it seemed that the crippling liabilities that had dogged Leeds

United for years were to be eradicated in one fell swoop. But

the club's financial affairs have rarely been straightforward

and there was a summer of intrigue to come during which a football

club nearly disintegrated.

The crisis had been brought to a head by a pre-emptive move from

Her Majesty's Revenue and Customs (HMRC).

United had been paying £200,000 a month to clear a historic tax

liability, but cashflow problems led to a failure to meet the

payments in March and April, breaching the terms of a 'time to

pay' agreement. HMRC lost patience and served a winding up petition

on April 17, meaning that if the club could not clear its £5m

debt by 27 June, it could be forced into liquidation.

This came as something of a surprise. Bates had been boasting

for some months that the club was now trading profitably and the

crippling effects of exorbitant contracts with the likes of Danny

Mills were almost at an end. To underpin their position, in the

9 months to March United had raised £7.3m from the sale of players,

including Rob Hulse, Matthew Kilgallon and Simon Walton, and received

a settlement of around £4m from Chelsea for the tapping up of

two youth players. Additionally, Astor Investment Holdings had

loaned the club £11.3m between August 2005 and October 2006 and

the Forward Sports Fund had paid £2.5m for shares in the club.

Money was evidently still pouring out of Elland Road.

back to top

On 14 May, KPMG wrote to creditors, summarising the state of

play, announcing the details of the creditors meeting planned

for 1 June and listing around 1,350 unsecured creditors totalling

£38,100,038. This was summarised as follows:

summarised as follows:

- Astor, a British Virgin Islands-registered company £12,726,687

- Shortfall to football creditors £8,089, 955

- HMRC £6,866,516

- Trade creditors £3,216,496

- Krato Trust, another offshore company, registered at a PO

box in Charlestown, Nevis in the West Indies £2,492,761

- Forward Sports Fund, the Swiss-based main shareholders of

the club £2,419,000

- Compensation fees due to ex-players £631,595

- 20 year season ticket holders £625,163

- Agents fees £407,697

- Finance leases £257,600

- Deposits £127,089

- Unsecured element of employee claims £108,966

- Memberships and subscriptions £106,378

- Pensions £24,134

The deal put forward by Bates was for a payment to non-football

creditors of 1p in the pound, meaning that HMRC would receive

just £69,000 in settlement of the £6.9m debt.

There were two major barriers to Bates' scheme: the interest

of rival bidders and the taxman's intransigence.

Intense press speculation followed about potential bidders, including:

- former Sheffield United chairman Mike McDonald

- former Hull City chairman and United director Adam Pearson

- Yorkshire-based internet tycoon Peter Wilkinson

- Las Vegas-based billionaire Dominic Marrocco

- Microsoft co-founder Paul Allen

- former West Ham chairman Terry Brown

- Leeds United Supporters Trust

- a consortium headed by Dubai-based Sheikh Samir A S Mirdad,

chairman of the Linx Group

- Duncan Revie, the son of legendary

United manager Don.

Revie's family connection appealed to the fans and made him the popular

choice. He confided in the Mail on Sunday, 'What is happening to

Leeds is a bloody disgrace. When things get this bad, I can't ignore it.

My feelings run  too

deep. I am interested in trying to get Leeds back where they belong, which

is in the top six of the Premiership. I've held talks with some influential

people and the feedback has been good. I will be holding more talks in

the next few weeks. The money is not a problem ... But that is not the

point. I will not make any approach until I am 100 per cent certain that

I can find the management team that will put Leeds United back on its

feet.'

too

deep. I am interested in trying to get Leeds back where they belong, which

is in the top six of the Premiership. I've held talks with some influential

people and the feedback has been good. I will be holding more talks in

the next few weeks. The money is not a problem ... But that is not the

point. I will not make any approach until I am 100 per cent certain that

I can find the management team that will put Leeds United back on its

feet.'

Revie refused to commit himself to the timescales set by KPMG

and hinted that he would bide his time. That left the most tangible

hopes resting with Simon Franks' Redbus investment vehicle and

Simon Morris.

29-year-old Morris was the major investor in the

consortium that bought United in 2004. He was a property entrepreneur

and had recently been named among the top 10 richest Britons under

30, with a fortune estimated at £69m.

It was understood that a key element of his plans involved buying back

the Elland Road stadium and developing land around it into an entertainment

complex. Morris spoke of building a 50,000-seater stadium as part of a

£400m 'world-class leisure venue'. He also claimed that he would provide

a further £25m to bring financial stability to Elland Road.

back to top

At the end of May, Harry Harris wrote: 'An attempted £1billion business

coup designed to discredit Leeds chairman Ken Bates, remove him from power

at Elland Road and buy up the stadium for redevelopment, has been uncovered

by the Daily Express. The plan, commissioned by would-be Leeds

buyer Simon Morris, entails compiling a black book on Bates and others

involved in the ownership of land adjacent to the club. Elland Road plus

two other sites would net £1bn according to a confidential memo.

'Code-named Project Peacock, the plan was drawn up last month. The intention

was to activate it as the club hit their lowest ebb - once relegated and

then wound up.

'The document outlines Project Peacock in "The Brief". It explains

that the 'target development area' consists of three sites adjacent to

one another - Elland Road (owned by Jacob Adler); a British Road Haulage

site owned by the Castle family and over which Stanley Leisure has an

option which expires on 2 July; and a council-owned plot.

'Project Peacock's objective is to acquire all three sites for development,

relocating Leeds United to a site nearby which would be supported by retail

outlets and a 50,000-seat arena.'

The other major bidder, Simon Franks, was head of the Redbus

Group, a corporate fund that specialised in turning around ailing

companies.

The Redbus approach was lower key than the Morris plan, although

Franks was ardent in his pursuit of the opportunity. Redbus claimed

to have £35m at its disposal and, after paying off creditors,

would commit the remainder to player wages and transfer fees rather

than to the buyback of the freeholds at Elland Road and the Thorp

Arch training ground.

Even with so much interest in the club, there was still a shadow

on the horizon.

HMRC had long been fiercely opposed to the requirement for football

creditors to be treated as preferential creditors, thereby reducing

the money available to normal creditors. In 2004, HMRC took  Wimbledon

to the High Court in an unsuccessful attempt to overturn the ruling.

Their failure only made them more determined to find another high

profile test case - Leeds United were the perfect candidates.

Wimbledon

to the High Court in an unsuccessful attempt to overturn the ruling.

Their failure only made them more determined to find another high

profile test case - Leeds United were the perfect candidates.

An HMRC insider told the Daily Telegraph: 'We are furious at the

raw deal we have got out of this debacle. We are getting a penny in the

pound for £7m of public money which should be used to pay for hospitals

and schools and other important public services.'

But Ken Bates loved a fight and he had an ace in the hole, knowing that

Astor Investment Holdings could effectively veto any bid as they held

more than 25% of the voting powers. There was more, as The Guardian

reported: 'Both Krato and Astor Investment have told the administrator

they have no connection to Bates, Forward Sports Fund or any other director

of Leeds. (KPMG) had made "fairly extensive inquiries" to confirm

there was no legal connection between them and said, in fact, the owners

of Astor were unknown.

'Krato and Astor have stated that they have no connection with Forward

or Bates. Nevertheless they have agreed to the proposal to sell the club

to Forward for 1p in the pound, even agreeing to reduce the amount they

will receive. Astor has agreed to write off half its claim if creditors

approve the sale, while Krato has agreed to accept nothing at all.'

When KPMG were asked why the two anonymously-owned offshore entities

should agree to write off millions of pounds in return for a sale to a

new company in which they stated they have no interest, joint administrator

Richard Fleming said: 'At the time we agreed it, there were no other offers.

Maybe they had football in their hearts and wanted the club to survive.'

And thereby hung the reason for the widespread criticism.

It was widely rumoured that both Astor and the Krato Trust were inextricably

linked with Bates. Astor was a British Virgin Islands-registered but Guernsey-managed

company. A Private Eye article in June claimed, 'A similar opaque

arrangement for many years was said to lie behind the Guernsey company

Swan Management which controlled the largest shareholding in Chelsea when

Bates was chairman. Swan was linked to Guernsey accountant Patrick Murrin,

a one-time Chelsea director. Interestingly, Krato shares the same Nevis

address as Rivoli - a company linked with Murrin, a long-time associate

of Bates. It now emerges that Rivoli had factored a debt due from Sheffield

United- paying a discounted amount up front and looking to make the collection.

Rivoli was owed £625,000 when the Leeds music stopped. Murrin, like Astor,

also had an interest in Forward Sports Fund which is registered in the

Cayman Islands.'

Private Eye also drew attention to Astor's actions in seeking

a debenture in March, during the lead up to administration, implying the

move was a thinly veiled attempt to manipulate any future vote of creditors.

Bates' offer and five other bids were put to the creditors on 1 June:

- Consortium of UK businessmen backed by US fund - £109k to

unsecured element of employee claims, £3.2m to unsecured creditors

- US fund - Up to £3m to unsecured creditors, request to hold

discussions with investor creditors

- Private individual - £1.5m to unsecured creditors, £4.5m to

pay towards the club's running costs in May and June

- US fund - £109k to unsecured element of employee claims, £3.3m

to investor creditors, £1.2m to other unsecured creditors, plus

some conditional payments

- Consortium of UK businessmen backed by US fund - £1m to unsecured

creditors, £8m to Astor, plus a share in the gross development

profit following redevelopment of Elland Road

The meeting was held in the Banqueting Suite at Elland Road and

was attended by somewhere in the region of 200 people.

back to top

KPMG stressed that Astor and the Krato Trust would only  support

the Bates bid and held a sufficient share of votes to defeat any

other offer. As a consequence of this, little time was given to

elucidating on the merits of the other bids. Morris' offer was

the most generous, amounting to a settlement that would return

18p in the pound.

support

the Bates bid and held a sufficient share of votes to defeat any

other offer. As a consequence of this, little time was given to

elucidating on the merits of the other bids. Morris' offer was

the most generous, amounting to a settlement that would return

18p in the pound.

The Times: 'The administrators' report to creditors said with

legal precision: "The Forward Sports Fund are the only connected

creditors of the company as far as the administrators are currently aware

on the basis of the information provided to them to date." In other

words, they found no connection between Bates, Astor and Krato. Bates

has signed a declaration denying any links to Astor. So has Mark Taylor,

who sat alongside him on the old Leeds board and who is also involved

in the new bid. Astor has written a letter saying it has no link to Bates.

But Friday's meeting brought a bombshell revelation. Former Leeds chairman

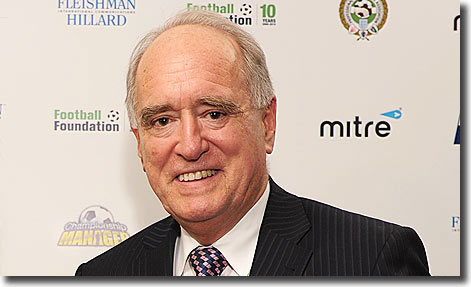

Gerald Krasner, himself an insolvency expert, subjected KPMG's Richard

Fleming to more than an hour of forensic questioning. He taunted the administrators

with the fact - disclosed in Leeds' 2006 accounts - that Astor had been

linked to Bates' Forward Sports. Fleming said stiffly: "It's the

first time we have been made aware of it."

'There was more trouble to come. Fleming had said flatly that failure

to secure a deal to rescue Leeds would automatically mean it lost its

League status. But up popped the League's solicitor, Nick Craig, to point

out it need not happen "in exceptional circumstances". The League

has more than a passing interest. It is owed £177,000.

'The agitating by Krasner and his allies did produce one small victory.

Mark Taylor promised an extra payout for creditors if Leeds returns to

the Premiership within five years. But as the voting approached, there

were murmurs of 'stitch-up' as the combined might of the creditors backing

Bates was assembled.'

Mark Taylor accepted that there had been an association between Astor

and the Forward Sports Fund as of 30 June 2006, but then asserted, 'There

isn't now.'

After prolonged delays Fleming announced that Bates' offer had

received the necessary support, but, at 75.02%, by a very narrow

margin. He said that as a result of statements made during the

meeting that a Court challenge was possible and decided to adjourn

the meeting until 10am the following Monday, 4 June, to allow

a recount of the votes.

That recount showed a slightly larger vote in favour, 75.2%,

and Fleming confirmed that Bates' bid had been successful.

Among those voting against were HMRC, the Football League, Gerald

Krasner, Melvyn Levi, Simon Morris, Kevin Blackwell and David

Healy. The margin of success was £70,683 on a total vote of £36.1m

and it would have taken only a couple of parties to change their

vote for the deal to have been blocked.

Other points of contention were some of the rulings made by KPMG

as to allowable votes. Between them, Krasner, Morris, Levi and

Blackwell had claims of £21.2m, but only £6 was admitted to vote.

Further to this, as reported later by The Guardian, doubts were

raised about some of the value attached to votes. 'The two specific cases

raised by MPs yesterday were that of Yorkshire Radio, which declared no

claim in the preliminary statement that was issued to all creditors but

whose demand in the final document circulated at the vote was for £480,000.

Four of the directors of Yorkshire Radio also had board positions in the

club. The second case related to Mark Taylor & Company, whose principal,

Mark Taylor, is a director of both the club and the takeover consortium.

The company's initial claim rose from £59,756 to £273,615.32 in the final

analysis. "There was no point billing because I knew I wouldn't have

got paid," said Taylor yesterday. "I knew the club did not have

a lot of free cashflow. But the work had been done, so I was perfectly

entitled to do that."'

Despite all the doubts, the only way that the Bates takeover could now

be blocked was by a formal legal challenge. KPMG: 'There is now a 28-day

period which allows any creditor who wishes to dispute the CVA to go to

court, so the club will stay in administration officially for a further

28 days.'

HMRC quickly indicated that they would be challenging the decision, though

they waited until the very last moment, 4pm on Tuesday 3 July, to formally

confirm this. Over the intervening month, Bates had been locked in desperate

negotiations with HMRC to avoid a legal challenge, gradually increasing

the value of his bid. This was despite his bullish public utterances:

'The Inland Revenue acted extremely unreasonably. Over the last two-and-a-half

years Leeds have paid between £15m and £20m to the Revenue, but our cash

flow dried up and we asked for a holiday. The Revenue said no and put

forward the petition to wind up the club. I'm sorry small creditors have

lost money, but that is totally down to the Revenue. We were happy to

pay everyone over a period of time. The fault for Leeds United creditors

should be placed fairly and squarely at the Revenue's door.'

On 2 July, United issued the following statement: ;After meetings with

the Inland Revenue the administrator has negotiated an improved offer

to the creditors of Leeds United, offering them a further amount equal

to approximately 7p in the pound ... The original agreement also included

provision for a further £5m payment to creditors (approximately 30p in

the pound) should the club reach the Premier League within the next five

years. This period of time has now been extended to 10 years. This payment

compares favourably with dividends paid by other football clubs that have

been through the Administration process and with any offers that the Administrators

received prior to approval of the CVA.

back to top

'This offer is unconditional, subject to there being no challenge to

the administration and the Football League transferring Leeds United's

share to the NewCo. This offer is better than any other alleged offer

that has been made, all of which were subject to conditions and due diligence.

'If the CVA is challenged the consequence will be liquidation and Leeds

United will cease to exist and the loss of 500 jobs would be a further

drain on government resources with unemployment and social security benefits.

'It is our view that any appeal now will not be made on commercial grounds

but is either politically or personally motivated.'

Despite the improved offer, HMRC formally served notice of their attention

to appeal on 4 July. Two days later, it was announced that the hearing

would take place on 3 September. This left United's chances of competing

in the new season in doubt and KPMG responded instantly, announcing, 'We

are putting the club up for sale and offers must be in by 5pm on Monday

(9 July) and we are interested in talking to other parties.'

The decision sparked another hasty round of activity, both among

the press and the preferred bidders, including Redbus and Simon

Morris.

Simon Franks insisted he would fight 'tooth and nail' to gain control

of the club and admitted he was considering joining forces with Morris

to block Bates, adding, 'It is an absolute travesty. KPMG have asked us

to submit bids by 5pm on Monday, but they are not giving us access to

the management accounts. We have no idea what we are bidding for. I am

livid and it is a travesty.'

Franks was heavily critical of KPMG. As well as the timetable, he was

angry that bidders were unable to gain assurances over exactly what assets

were on offer - particularly whether they would be guaranteed to receive

the money banked from 9,000 season ticket sales. Describing the process

as 'crazy' and 'gob-smacking', he said: 'We may be bidding for something

we actually can't have, so it's frustrating and a little bit scary. It's

the first time in the history of our company we've taken part in such

a blind auction, but there you have it ... Our bid is still higher than

Bates' last published bid, but it is lower than we originally had.'

In the end, four bids were lodged with KPMG by the deadline and

a final decision was postponed until noon on 10 July to ensure

that bidders could demonstrate proof of funds. Eventually it was

announced that Bates' offer had been successful, but only because

of Astor's agreement to waive its right to a dividend from the

Bates deal. That reduced the value of the creditors to £12.6m,

as opposed to £30.2m for the other three offers, thus substantially

increasing Bates' pennies in the pound payment. It was later reported

that his deal was worth 11.2p in the pound, against the next best

deal of 10.3p. If not for Astor's waiver, Bates' package would

have been worth just 4.7p. The other bid offered £1.7m more in

cash than Bates.

Simon Franks was clearly gutted at missing out, saying, 'Obviously I'm

very disappointed. It's been a tortuous process and we put together what

we thought was a very brave bid. We have to remember that in the last

bidding, almost a month ago now, that our bid was significantly more than

Mr Bates'. I think we provided proof of funds of £10m against his £350,000

- and we still lost by the vagaries of the process that we're in. I cannot

believe that anybody outbid us but, in administration, the process is

very vague.'

Redbus believed that despite Astor's waiver, theirs was ultimately the

biggest offer KPMG received for Leeds. In its documents the administrator

did not account for an additional £8m that would have been paid by Redbus-Morris

in the event of the transfer of the Football Share which would allow the

newly owned Leeds United to kick off the new season. KPMG justified this

by saying that 'the additional £8m was to be used to settle football creditors.

It is a condition of the League that such football creditors are paid

in full in the event of agreement to transfer the football share. Therefore,

all the offers must satisfy this requirement and make such funds available.

Accordingly, even if the above offer had been capable of acceptance, it

would not have changed the administrators' decision to sell to [Bates].'

Redbus Chief Executive Dean Dorrell claimed that there had been no such

provisos set on the £8m payment. 'The only condition we put down on our

£11.501m bid was that £8m of it would be paid upon transfer  of

the Football League and [Football] Association shares,' he said. 'There

was no condition whatever of where that £8m would be paid: to the Football

League, football creditors or other such.'

of

the Football League and [Football] Association shares,' he said. 'There

was no condition whatever of where that £8m would be paid: to the Football

League, football creditors or other such.'

Ken Bates was delighted to retain ownership of the club, saying, 'Leeds

were in a mess when we took over ... But now we've got a clean start and

a clean sheet of paper. It's a big club ... and we can take it forward.

The delays have been annoying. Part of the delay has been caused by people

who've professed to love this great club and done their damnedest to cause

as much trouble as they can.'

back to top

KPMG sent a letter out to creditors on 24 July detailing the terms of

the actual sale to Ken Bates and comparing it with the other offers. Click

here to read the letter in full.

It was generally accepted that it would now be a mere formality

to regain the League Share that was required for United to start

life in League One, but getting agreement was soon found to represent

another serious obstacle.

The Football League's board was expected to rubber stamp the CVA at their

meeting on June 6 in Portugal. However, they refused to do so, deciding

instead to defer any decision until their following meeting, on 12 July,

and issuing the following statement: 'For legal reasons, it will now take

a further 28 days for the CVA to be formalised. During that period, the

League can make no further comment. The League has also confirmed to the

administrator the conditions that must be satisfied before the League

board can consider transferring the club's share in the Football League

to the new company.'

After the meeting on 12 July 12 they issued the following statement:

'To date, no documentation regarding the sale has been submitted to the

League by the administrators. Notwithstanding this, the board was asked

by the reported purchasers to consider an application to transfer Leeds

United's share in the Football League to them. The board was unable to

consent to this request this morning. Instead it has requested, from the

administrators, certain required documentation and assurances regarding

the sale of the club. The board also requires certainty on the current

legal proceedings surrounding the administration.

'The board had been expecting the administrators to attend today's meeting,

as KPMG originally requested. However, the League was informed late yesterday

afternoon that they would not be attending, with no explanation provided.

Additionally, the board expressed concern at the handling of the whole

process by the administrators and the chairman was instructed to obtain

legal advice in that regard.

'Clearly any further delays in this process will be frustrating for Leeds

supporters. However, like the club's fans, the board recognises the pressing

need for certainty regarding the future of league football in Leeds and

has agreed to convene at the earliest opportunity to reconsider the share

transfer, once it has been provided with all the relevant information.

'Also, for the avoidance of doubt, the League would like to make it clear

that there is nothing in its regulations to prevent a club beginning a

new playing season whilst in administration.'

United and KPMG rushed the requested documentation through to

the League, but there was then silence for a couple of weeks.

Football League representatives met with officials from United

and KMPG on 31 July and spent hours trying to agree the return

of the Football Share.

The League insisted that United had to leave administration via

a CVA. Chairman Lord Mawhinney said, "I spoke personally at length

to the highest levels of KPMG and Leeds United 2007 on Monday

and we then had a  four

hour meeting here on Tuesday. We all agreed that the best way

to proceed was to try and reconstitute the CVA. This is the normal

way we get clubs out of administration. We have had 41 previous

clubs who have been in administration and all of them have gone

down this route, and I expect to hear back from KPMG their considered

opinion by the end of the week."

four

hour meeting here on Tuesday. We all agreed that the best way

to proceed was to try and reconstitute the CVA. This is the normal

way we get clubs out of administration. We have had 41 previous

clubs who have been in administration and all of them have gone

down this route, and I expect to hear back from KPMG their considered

opinion by the end of the week."

By 2 August KPMG had responded, rejecting the calls to reconstitute

the CVA, arguing that the intransigence of HMRC meant such a move

was doomed to failure.

Then came a totally unexpected turn of events.

The Football League accepted there were 'exceptional circumstances' but

decided they could not allow Leeds to operate in contravention of their

Insolvency Policy. 'The Football League Board agreed that, notwithstanding

the manner in which this administration has been conducted, the club should

be permitted to continue in the Football League,' said a statement. 'Consequently,

the board has decided to make use of the "exceptional circumstances"

provision within the League's Insolvency Policy, for the first time, and

agreed to transfer the club's share in the Football League to Leeds United

2007 Ltd. Accordingly, the club's share has now been transferred.

'However, it is acknowledged the club did go into administration and

has been unable to comply with the terms of the League's well-established

Insolvency Policy. As a result, the board determined this transfer of

membership should be subject to Leeds United having a 15-point deduction

applicable from the beginning of the 2007/08 season. Leeds subsequently

have lodged an appeal against this sanction, which will be heard at a

special meeting of all League clubs, to be arranged in due course.'

United appealed against the penalty, with the other 71 League chairmen

sitting in judgement. Ken Bates was incandescent about these arrangements,

pointing out the obvious conflict of interests. His complaints fell on

deaf ears and got Bates absolutely nowhere - the chairmen supported the

League's decision by an overwhelming majority.

It was like a death knell for United's promotion hopes, but at

least they could finally start making preparations for the new

season.

There was some good news on 30 August, with HMRC formally withdrawing

their legal challenge, due to be heard four days later. A spokeswoman

said it had become 'academic"' when the CVA was ditched in early July.

She would not be drawn on why it had taken the Revenue nearly two months

to formally kill off the case and nor would she elaborate on what steps

the taxman intended to take regarding the money owed.

It had taken four months, but finally one of the most dramatic

periods in the intriguing history of Leeds United had drawn to

a close and attention could return to onfield affairs.

Part 2 The fightback begins - Part

3 Return of the Mac - Results and table

Administration and aftermath - The

Chronology

back to top

summarised as follows:

summarised as follows:

too

deep. I am interested in trying to get Leeds back where they belong, which

is in the top six of the Premiership. I've held talks with some influential

people and the feedback has been good. I will be holding more talks in

the next few weeks. The money is not a problem ... But that is not the

point. I will not make any approach until I am 100 per cent certain that

I can find the management team that will put Leeds United back on its

feet.'

too

deep. I am interested in trying to get Leeds back where they belong, which

is in the top six of the Premiership. I've held talks with some influential

people and the feedback has been good. I will be holding more talks in

the next few weeks. The money is not a problem ... But that is not the

point. I will not make any approach until I am 100 per cent certain that

I can find the management team that will put Leeds United back on its

feet.' Wimbledon

to the High Court in an unsuccessful attempt to overturn the ruling.

Their failure only made them more determined to find another high

profile test case - Leeds United were the perfect candidates.

Wimbledon

to the High Court in an unsuccessful attempt to overturn the ruling.

Their failure only made them more determined to find another high

profile test case - Leeds United were the perfect candidates. support

the Bates bid and held a sufficient share of votes to defeat any

other offer. As a consequence of this, little time was given to

elucidating on the merits of the other bids. Morris' offer was

the most generous, amounting to a settlement that would return

18p in the pound.

support

the Bates bid and held a sufficient share of votes to defeat any

other offer. As a consequence of this, little time was given to

elucidating on the merits of the other bids. Morris' offer was

the most generous, amounting to a settlement that would return

18p in the pound. of

the Football League and [Football] Association shares,' he said. 'There

was no condition whatever of where that £8m would be paid: to the Football

League, football creditors or other such.'

of

the Football League and [Football] Association shares,' he said. 'There

was no condition whatever of where that £8m would be paid: to the Football

League, football creditors or other such.' four

hour meeting here on Tuesday. We all agreed that the best way

to proceed was to try and reconstitute the CVA. This is the normal

way we get clubs out of administration. We have had 41 previous

clubs who have been in administration and all of them have gone

down this route, and I expect to hear back from KPMG their considered

opinion by the end of the week."

four

hour meeting here on Tuesday. We all agreed that the best way

to proceed was to try and reconstitute the CVA. This is the normal

way we get clubs out of administration. We have had 41 previous

clubs who have been in administration and all of them have gone

down this route, and I expect to hear back from KPMG their considered

opinion by the end of the week."