Part 1 - A nasty dose of reality - Part

3 - Dawning of a new era - Results and table

After

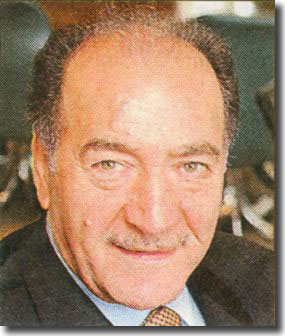

months of speculation it was confirmed on 19 March 2004, that insolvency

practitioner Gerald Krasner had negotiated a deal with the creditors of

Leeds United that allowed Adulant Force, the consortium he fronted, to

take control of the club and save it from the administration that had

seemed inevitable.

After

months of speculation it was confirmed on 19 March 2004, that insolvency

practitioner Gerald Krasner had negotiated a deal with the creditors of

Leeds United that allowed Adulant Force, the consortium he fronted, to

take control of the club and save it from the administration that had

seemed inevitable.

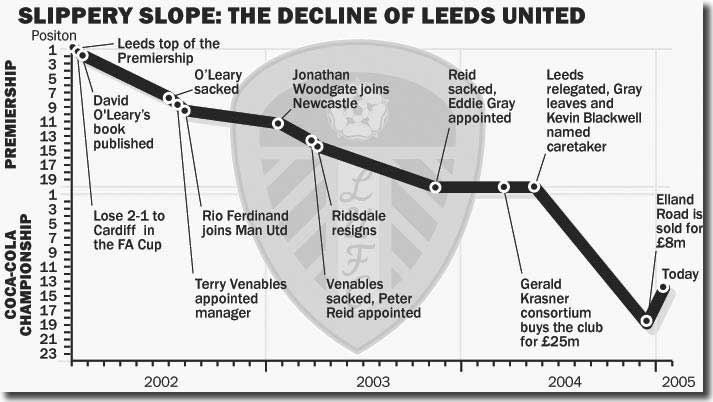

However, for anyone who assumed that the deal would lay United's financial

difficulties fully to rest, there was a nasty shock waiting in store.

It quickly became apparent that the buyout had done no more than earn

the club extra time to remedy their deep-rooted financial ills, and that

further support would be required to put Leeds United back on an even

keel.

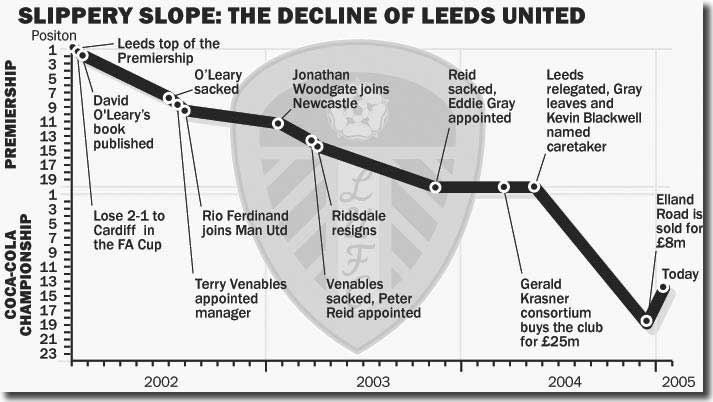

As reported in the Telegraph, 'the consortium … gambled on three

things. Firstly, they hoped the team could remain in the Premiership.

They didn't and were relegated with the massive

financial consequences that involves. Secondly, they hoped to raise

millions through a debenture scheme by selling thousands of 20-year season

tickets. With the club in the bottom three of the Premiership and facing

relegation, they sold around 100. And thirdly, they were advised by former

Bradford City chairman Geoffrey Richmond. An experienced football man,

Richmond had left Bradford with huge debts and, only weeks after his involvement

with Leeds was revealed, he was declared bankrupt.'

The Krasner deal had been a decent one, slashing the club's massive debt

from astonishing an £103m down to a much more sustainable £40m:

- Loan from Jack Petchey, secured against Elland Road - £15m

- Directors loans - £4.75m

- Income tax and VAT - £9m

- Former managers, players and agents - £8m

- Other creditors - £3.5m

A club balance sheet in September 2004 listed the following among the

creditors:

- Robbie Fowler £2,106,000

- Danny Mills £1,841,000

- Nick Barmby £1,055,000

- Robbie Keane £400,000

- David O'Leary £356,000

- Peter Reid £355,000

- Stephen McPhail £311,000

- Dominic Matteo £181,000

- Danny Milosevic £156,000

- Brian Kidd £87,000

back to top

Clearly, the desperate fire sales to rid the squad of some of the highest

earners in the country had come at a significant cost and there was bitterness

at the need to pay off players who had let the club down so badly. The

moves had demanded extensive use of agents and a Football League report

later revealed the extent of the damage. Leeds United had paid out £1.6m

in agents fees in the six months to 31 December 2004, comfortably the

highest amount paid by any club.

It was certain that Leeds would still have the highest wage bill in the

Football League in the new season, despite selling a host of stars. The

club had already slashed their annual salary costs from £57m to £41m in

the past year, but now planned further reductions.

Gerald Krasner: 'We will have to trim the squad slightly. That is largely

because we are still having to subsidise the wages of some players we

have got rid of. A player may have been on £40,000 a week here but only

receive £20,000 or £25,000 elsewhere, and we have to make up that shortfall

on his contract. Unfortunately in most cases there is no other way of

reducing our wage bill, some supporters do not seem to realise that. The

simple fact remains that if we do not start to live within our means there

will be no future for Leeds United. There were 18 players earning over

£1m a year when we came in and the total wage bill was over £40m. It is

down to an £18m maximum this season but, in order to ensure a viable future,

we still have to get the financial model right.'

To get that into some sort of context, £18m was still twice the First

Division average and six times the £3m paid out by Sheffield United. Krasner

recalled, 'We were paying one of our players more than Sheffield United

were paying their whole squad.'

Kevin Blackwell: 'Going into August, I had two contracted players available,

Gary Kelly and Michael Duberry. There were two others on the books, Seth

Johnson and Eirik Bakke, but they were both injured. The place was like

the Marie Celeste. I got 64 trialists in, from all over the world, panning

for gold. They were hard times.

'The Inland Revenue started calling in debts, and all our money was disappearing

into a black hole again, so we sold James Milner. On the Monday he was

"The New Face of Leeds United", by Friday he was a Newcastle

player. That's how it was then - like walking on quicksand.'

There were also bitter complaints that much of the money for the Adulant

Force deal had come from mortgages against the club's few remaining assets,

such as Elland Road itself, on which a £15m loan from Jack Petchey had

been raised. Documents filed at Companies House indicated that the board

had taken out eight new mortgages on property and land owned by Leeds

to fund their takeover and keep the club afloat in seven months after saving it from

bankruptcy.

takeover and keep the club afloat in seven months after saving it from

bankruptcy.

The immediate need for cash was down to the Petchey loan. The deal had

included significant penalties should any of the repayments be delayed

and Leeds desperately needed to improve their cash flow position.

They were making some good inroads into improving their trading position

by reducing the exorbitant salary bill, but that would only be of any

use if they could get their liabilities down to manageable proportions

with an inflow of cash.

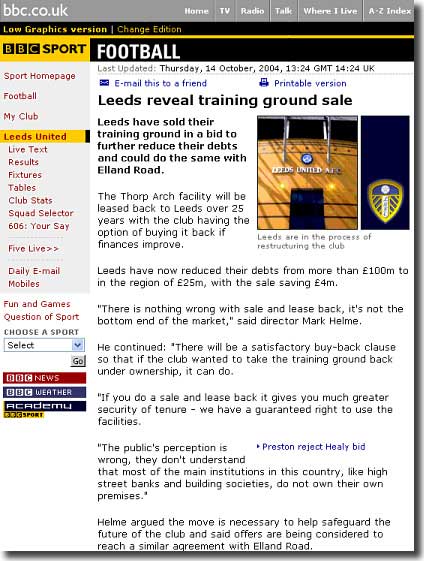

Gerald Krasner negotiated a sale and leaseback arrangement for the club's

Thorp Arch training ground and announced they would try and do the same

with the Elland Road stadium. He also distanced the club from rumours

of a takeover by British-based Iraqi billionaire Nadhmi Auchi.

According to the Sunday Times: 'A former Ba'ath party member whose

brothers were killed by Saddam Hussein's regime, Auchi left Iraq in the

late 1970s to settle in London. He is one of Britain's wealthiest and

best-connected citizens, yet maintains a low profile. Lord Lamont, a former

Tory chancellor, sits on the board of Auchi's holding company and the

billionaire hosts regular dinners attended by royals, Middle Eastern leaders

and MPs. He has also bought tables at Labour fundraising dinners. He has

quietly built a business empire comprising 120 firms across the world

in property, construction and hotels.

'However, his business dealings have often proved controversial. Last

year, in France, he was convicted of paying kickbacks to the oil firm

Elf. Auchi, who was born in Baghdad in 1937, received a 15-month suspended

jail sentence and a £1.39m fine. He says the prosecution was politically

motivated and is appealing against it. In Britain, a pharmaceutical firm

he owns is co-operating in a criminal investigation by the Serious Fraud

Office into an alleged price-fixing cartel involving supplies for the

National Health Service.'

back to top

Auchi's rumoured interest went no further, although it was clear that

Leeds United were actively pursuing other options.

Gerald Krasner: 'From day one we made it clear that we were looking at

two options; remortgage the ground or do a sale and lease back with a

minimum 25 year lease and a buy back clause. That position has not changed

one iota. Leeds fans are entitled to be angry if they think we will not

be playing football at Elland Road but we have always said that whatever

happens, football stays at Elland Road. It is not in the club's interests

to accept a shorter lease than 25 years, that is the minimum. In the talks

we're having there is  also

a clause to buy back the ground. That's at any point during the lease,

not necessarily at the end of it.'

also

a clause to buy back the ground. That's at any point during the lease,

not necessarily at the end of it.'

The deal for the Thorp Arch training complex, on valuable land near Wetherby,

saw it sold to Jacob Adler, a Manchester-based property developer, and

leased back over 25 years, with United retaining first option to buy back

the land if the financial situation were to improve. Krasner claimed that

once mortgages on the land around Thorp Arch were paid off, Leeds would

be left with 'in excess of £4m' to go towards reducing debts.

Shaun Harvey, the club's chief operations officer, said: 'In an ideal

world it's not an option we would have taken, but our number one priority

is to reduce this club's debt so it can operate again under normal circumstances.

This arrangement will go a long way to helping us do that. Instead of

paying the mortgage on Thorp Arch, we will be renting it instead, with

the players continuing to utilise the excellent training facilities available

there.'

John Boocock, chairman of the Leeds United Supporters' Trust: 'This is

a sign of desperation and proves that, as owners, they bought the club

on loans and have no money to invest. Nothing is sacrosanct at the club

- if they can sell it, they will. I have no doubt the board would love

to sell Elland Road. Twenty-five years is not a long time in football,

especially to those of us who have been coming to Elland Road for 40 years.

What happens to Thorp Arch when the 25 years are up? I can see Leeds United

having to train in a public park in the future. The only way forward for

a football club in this situation is to develop a strong youth policy.

Everything points to doing that and yet what we are doing is selling off

the very bedrock of a strong youth policy.'

On 18 October, The Times reported that the club had agreed another fundraising

scheme: 'Leeds' attempts to restore financial stability were boosted as

they sold off disused land adjacent to their Elland Road ground. The deal,

which will allow Stanley Casinos Limited to build a casino complex with

a hotel, restaurant, bars, leisure facilities and designer shops on the

newly acquired site, is subject to the reform of the United Kingdom's

gambling laws. Such plans will not have any impact on Elland Road remaining

the club's home, although a sale-and-lease-back arrangement of the ground

has not been ruled out.'

All the time, however, the search was on for more substantial investment

and on 24 October finance director Melvyn Helme hinted that a deal was

close. He would not comment on reports of a potential takeover but said

the board were making progress in attempts to find new money.

'Talks with a number of parties have reached an advanced stage,' he told

the Mail on Sunday. 'It would be wrong to comment on any one person.

I'm not sure which party will come forward in the end. We have had a policy

ever since we took over at Leeds that in view of all the various speculation

there has been, we have never commented on individual situations.

'We have just done a deal for the casino land at Elland Road and we were

talking to four or five casino operators. We have successfully concluded

a deal which is to the benefit of Leeds United and we did not comment

on any part of it before an announcement was made. It would be quite wrong

for us to comment on individual parties at this stage because at the end

of the day I am not sure which party will come forward and do a deal with

us.

'We are at an advanced stage of negotiations with various people and

we have to have a look at all the options on the table and choose the best one for Leeds United.'

options on the table and choose the best one for Leeds United.'

Towards the end of October, details started to emerge of two potential

suitors, despite the board's attempts to keep matters under wraps.

The first was a consortium led by Sebastian Sainsbury, 41, banker and

restaurateur and the great grandson of the founder of Sainsbury's supermarkets.

He had enlisted the financial backing of an American group, Nova Financial

Partners, run by the Miami businessman, Burl Sheppard, described as a

'hi-tech fundraiser'.

back to top

The second interested party was a group of local businessmen and Leeds

United supporters, headed by property tycoon Norman Stubbs.

It was soon apparent that there was a degree of antagonism between United's

directors and Sainsbury and that the board were more favourably disposed

to the Stubbs connection.

The Sainsbury proposals were based on an injection of £25m in new funding,

negating the need to sell the Elland Road stadium, but the Stubbs deal

depended on a sale and leaseback arrangement. The board insisted on seeing

physical proof that Sainsbury had the necessary finance at his disposal

and negotiations ended in acrimony with Gerald Krasner claiming that no

satisfactory proof had been forthcoming.

Things came to a head during a show on Radio Aire on Saturday, 6 November

2004 with a heated on-air argument between Sainsbury and Melvyn Helme.

Sainsbury insisted that he had provided proof of funds and claimed a

deal had been completed. A contract would be signed on Monday and the

deal completed by the transfer of funds on Thursday when he would become

club chairman.

Leeds had performed remarkably well in winning 4-2 that afternoon at

Deepdale, home of Preston North End, and Melvyn Helme joined the commentators

for a post match discussion. He was insistent that the club had not received

proof of funds. He explained that the proposals by the Nova group were

acceptable and that a contract would be signed once the required proof

of funds had been obtained. He also complained about the consortium continually

seeking to do their negotiations very publicly. He demanded that Sainsbury

either put up, or shut up.

At this point, Sainsbury joined the conversation by telephone. He said

proof of funds had been provided, though Helme claimed that the club had

only received a letter from a Canadian solicitor, unassociated with the

consortium, which stated he had been asked by them to write the letter.

Sainsbury said that asking for this level of proof was not a normal way

to conduct business. He couldn't understand why the club was delaying

and challenged Helme to confirm the discussion earlier in the Preston

boardroom. Sainsbury was asked why he couldn't simply provide the name

of the bank or an account number, which he declined to do, saying this

was not the way to conduct business. The two men repeatedly spoke over

and ignored each other.

The United board was bitterly divided, as reported in the Guardian that

same day: 'Stubbs is understood to have raised £10m and the proposed sale

and leaseback of the Elland Road stadium is expected to bring in a further

£15m. However, his backers insist all monies must be directed towards

the continued survival of the ailing club rather than rewarding those

directors under whose stewardship debts have been reduced from £104m to

slightly more than £30m.

'The current Leeds chairman Gerald Krasner is understood to be content

with Stubbs' offer but his view is not shared by two of his fellow directors,

who are pushing exclusively for Sebastian Sainsbury's Anglo-American consortium.

Sainsbury initially offered two board seats to the incumbents and a £2m

sweetener to the current directors, a proposal which is the subject of

further negotiation.

'However, in taking out £4.75m in directors' loans which helped facilitate

the initial Adulant Force buy-out of the club, the board used their homes

and businesses as security. Should both current takeover bids fail, directors

stand to lose their estates if the club goes under.'

The club's fractious impatience with Sainsbury and continual demands

to 'show us the money' were perhaps excusable - things were getting fraught

at Elland Road.

The club still owed £9.2m on the loan from Petchey and the next instalment

of £2.5m was due on November 14, with a £2m penalty if the payment was

missed. The United board set Sainsbury a deadline of 1pm on Friday, November

12 to complete the deal, which was always far too tight in the circumstances.

Sainsbury chose to back out and the club was left with little option but

to sell Elland Road. They arranged a 25-year leaseback deal with Manchester-based

businessman Jacob Adler, who had also bought Thorp Arch. The arrangement

allowed the debt to Petchey to be cleared in full and put around £8m in

the bank.

back to top

35-year-old Adler later sought to assure the fans that 'Your ground is

safe with me' and that he had 'no intention whatsoever' of building on

the site. In an interview with the Yorkshire Evening Post he also

rubbished claims that he had secret ties to the men who were on United's

board when the sale went through: 'I had never met Mr Krasner before,

I had never dealt with him before. Categorically, I had no connection

with anyone at Leeds United. [The transactions] came about through a property

agent who knew that Leeds were looking to sell and I might be interested

in buying. I have been described in the press as a property developer.

I have never developed anything in my life. I invest in property, and

this was commercially a great chance for me.'

While the sale might have made sound business sense it had enormous symbolic

significance to the supporters of the club, who despaired, convinced that

the directors' only strategy was to liquidate all their assets in a slow

and inevitable grind towards financial oblivion.

The Stubbs consortium was still interested and there were continuing

hints of a successful conclusion to discussions, but weeks went by with

no concrete news.

As December opened, there came another crisis as the club announced a

payment of £1.2m to the Inland Revenue was due on the 15th of the month

with an £800,000 VAT bill to be settled shortly afterwards. The club defaulted

on the payments and staggered on uncertainly until 17 January when they

announced that they had only 10 days left to avoid administration.

Kevin Blackwell: 'One Friday in January, out of the blue the stock exchange

pulled the plug. It was a terrible day, with staff crying all around me.

We weren't going into administration - that had already been done and

all the assets had been sold - it was straight to liquidation. The doors

were going to be closed on the Monday. We'd all had e-mails, saying we

wouldn't be paid. The wages had only been paid in December because I sold

Scott Carson to Liverpool.'

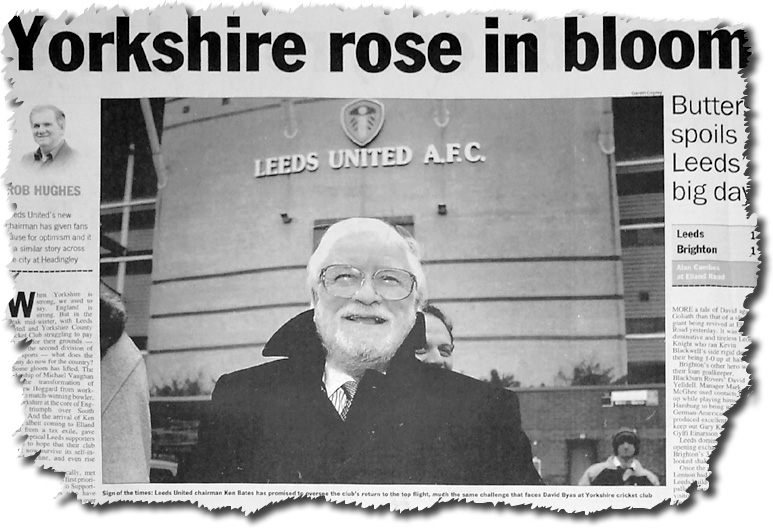

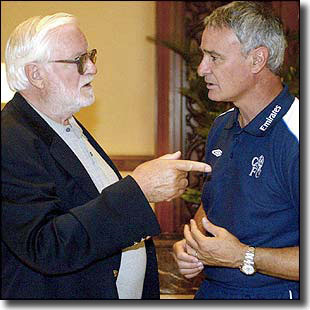

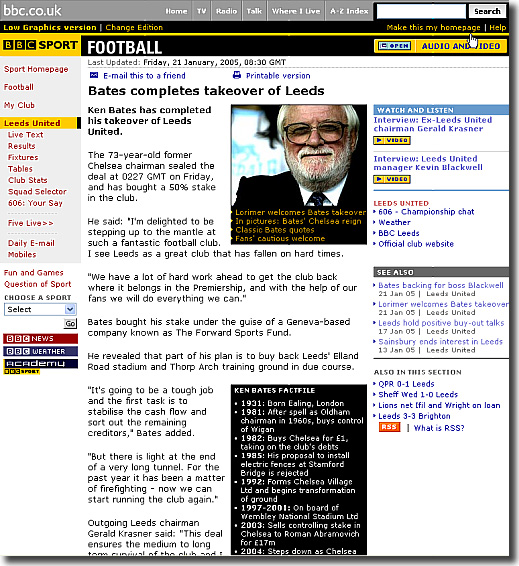

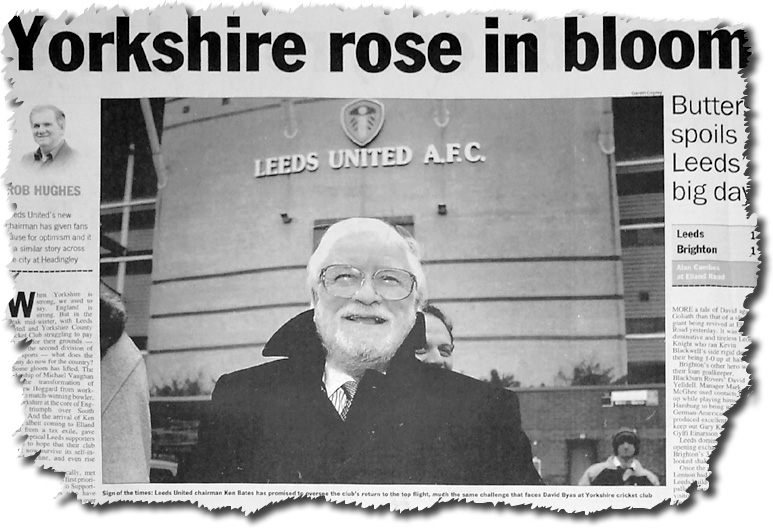

Then in the nick of time there was some astonishing news, as former Chelsea

owner Ken Bates came into the equation. The irascible and controversial

73-year-old had stepped down as chairman at Stamford Bridge after the

arrival of Russian billionaire Roman Abramovich. Under the terms of that

deal, which saved Chelsea from financial meltdown and netted Bates a personal

windfall of £17m, he was due to remain as the chairman until the end of

the season, when he would have become a life president. The appointment

of Peter Kenyon as Chelsea's chief executive led to conflict, and Bates

cited 'a clash of Eastern and Western cultures' as he made an earlier

exit than planned. Over recent months Bates had attempted to take control

at Sheffield Wednesday but his overtures had been unsuccessful.

The first hint of Bates' possible involvement with United came in a report

in the Independent on 10 January:

'In a move that is likely to stun Leeds supporters and arouse curiosity

much further afield, Bates, 73, is understood to have offered the money

to become part of a takeover at Elland Road being attempted by Sebastian

Sainsbury. Although a deal is still some way from completion, talks between

Sainsbury and the Leeds chairman, Gerald Krasner, are ongoing about a

£25m buy-out. The next round of talks is scheduled for tomorrow.

'Bates and Sainsbury, accompanied by brokers and agents, were seen lunching

together at the Dorchester Hotel in central London last week. According

to one source, Bates told Sainsbury he would invest £10m in Sainsbury's consortium in exchange for

51 per cent of Leeds and the role of chairman.'

Sainsbury he would invest £10m in Sainsbury's consortium in exchange for

51 per cent of Leeds and the role of chairman.'

Sainsbury's deal collapsed shortly afterwards and it seemed that the

Stubbs consortium was the only show in town as bankruptcy beckoned. But

the interest of Ken Bates had been piqued and a shock takeover was completed

at 2.27am on Friday 21 January 2005.

back to top

Under the auspices of the Geneva-based Sports Forward Fund, Bates invested

around £10m in Leeds United, securing a 50% controlling stake. He would

have gone for a larger holding, but the finer details of Adulant Force's

settlement with the bondholders in 2004 meant that the sale of any greater

share would have incurred significant financial penalties. The restriction

lasted until March 2007, when it was expected that Bates would buy up

the remaining half of Leeds United.

The Bates money cleared £2.8m owing in VAT and tax, a £620,000 loan from

former director David Richmond, an annual payment to bondholders of £1.4m

and a number of other liabilities, bringing the total debt down to around

£17m. A repayment schedule was agreed with the Inland Revenue and Customs

and Excise for the remaining £4.2m and it was agreed that £4.1m of other

directors' loans would remain invested in the club for a further four

years, leaving Bates to crow that only £9m was 'outstanding'.

The figures quoted did not include a schedule of 'League Performance

Amounts' that were agreed with the bondholders as part of the Adulant

Force takeover. An annual sum of £1.4m was owed annually until 2008, rising

to £2.5m in the Premiership, with an additional one-off payment of £5m

payable on promotion. The deal could also see the club paying £500,000

per year until 2025.

The investment by Bates rescued the club as it seemed all hope was gone,

but the new chairman was a controversial figure in football circles, and

some United supporters reacted angrily to his involvement.

John Boocock: 'This is the man who wanted to put up electric fences at

Chelsea and his business track record leaves a lot to be desired. At no

point has he shown any interest in Leeds as a club or a city. He just

wants to have a toy to play with. If he is doing this without due diligence,

he is not aware that the club needs far more.

'My mother has just rung me and asked should we laugh or cry and I told

her to cry. We wouldn't want him to come to Leeds as a visiting director,

let alone become our new chairman. He's an old man who should stay at

home and look after his garden. If he wants a bit of excitement he can

go to bingo or take his wife to WI meetings. Bates is just a carpet-bagger

who will buy any club that will have him in the hope that he can get back

his seat on the FA. This just shows how little chairman Gerald Krasner

and his colleagues know when it comes to Leeds United and the fans. They

are just in this for whatever they can get themselves.'

Simon Jose, of the Leeds United Independent Fans' Association: 'I would

rather we started afresh in the Conference than have him in charge. It's

like the four horsemen of the apocalypse selling to Lucifer. We need a

clean sweep and a fresh start. This is like putting King Herod in charge

of babysitting.'

There

were some welcoming words, however, from others. Peter Lorimer, whom Bates

asked to remain a director: 'The board did a great job knocking £80m off

the debts but now the club has to go forward and I'm sure Ken is the right

man. I'm sure he knows what is needed and what to do about the finances.

The team has been rebuilt and we are moving ahead.'

There

were some welcoming words, however, from others. Peter Lorimer, whom Bates

asked to remain a director: 'The board did a great job knocking £80m off

the debts but now the club has to go forward and I'm sure Ken is the right

man. I'm sure he knows what is needed and what to do about the finances.

The team has been rebuilt and we are moving ahead.'

Norman Hunter: 'I'm delighted. First and foremost, the situation is resolved

at the moment. It was a trying situation and I don't think it's enough

in the long run but I think Ken Bates will sort something out. If he does

anything like the job he did at Chelsea, the Leeds public will be absolutely

delighted.'

back to top

Outgoing United chairman Gerald Krasner: 'We met Ken Bates on Monday

in London and discussed at length the outline of the deal that was necessary

for Leeds United. We shook hands on it and the board backed it unanimously

on Tuesday. We got him into Leeds on Wednesday without anybody knowing

and this morning it was concluded. I have to pay tribute to Ken because

he has not moved one iota from the handshake we had on Monday. He's sat

down with us man-to-man, not done due diligence and I like the way he

does business. He's kept his word and you can't ask for any more.

'What this takeover will enable Leeds United to do is consolidate its

position much quicker than the old board was able to do. The debts were

£103m and are now under £25m. We have done 80% of the work; Ken will do

the rest and take Leeds United back to the Premiership where they belong.

'Ken has long term plans here, he's had a year's sabbatical and he's

come back to show everyone he can do it all again. I think that when the

Leeds fans hear his plans they will be pleased.'

Former chief executive Trevor Birch, who knew Bates from their time together

at Chelsea: 'Ken's involvement is good news for Leeds. The club has suffered

a lot in recent years and one thing about Ken is he is a very determined

man. He will not have bought Leeds to preside over its demise. He will

have very definite plans, you only have to look at the success he has

achieved in the past to realise he will not want the club to stand still,

which can only be good news for the fans.'

Bates had always provoked extreme views among the football public, with

people either loving him or hating him. His long and chequered past had

guaranteed that controversy would dog him wherever he went.

Ken Bates was born on 4 December 1931 and spent his childhood on a council

estate in Ealing, West London. He showed an aptitude for business from

an early age and made his money from ready mixed cement, dairy farming,

sugar cane and land development.

Despite his commercial interests, Bates was always a football fanatic

and took over at Oldham Athletic in 1965. He shook up a sleepy little

club, swapping bright orange shirts for the traditional blue and white

colours, and he brought in a number of new players for his first game.

He later took control of Wigan Athletic for a brief period in 1981 before

buying up a debt-laded Chelsea a year later for £1 as they teetered on

the verge of relegation to the old Third Division.

For five years from 1986, he served on the Football League management

committee before resigning after Chelsea were fined £105,000 for alleged

illegal payments to players.

In the early 1990s, Bates formed Chelsea Village Limited with the ambitious

intention of transforming the Stamford Bridge ground with a hotel complex

and other leisure pursuits. On the footballing side he gambled on Glenn

Hoddle as manager before losing him to the England job, and went on to

hire and fire Ruud Gullit and Gianluca Vialli in the pursuit of further

success, with both managing to bring silverware to the club during short

and controversial stays.

He managed to transform an outdated and dilapidated Stamford Bridge into

a modern, state of the art stadium and did likewise with the football

team, although Chelsea's debt rivalled United's in the year preceding

their rouble-fuelled revolution. The Stamford Bridge deal had injected

new wealth into the surrounding neighborhoods, resulting in new jobs and

many homes for sale. Would the same thing happen at Elland Road?

In 2003, Bates sold his controlling interest in the club, apparently

to retire to a Monaco tax haven. He couldn't stay away from football forever,

though, and came close to investing in Sheffield Wednesday before declaring

his interest in  Leeds

United.

Leeds

United.

Bates was best known for his acerbic nature and his controversial comments

on the game and people within it:

- On the Football Association's disciplinary procedures: 'At first they

were a shambles. Now they have descended via farce to make them a laughing

stock. It has come to a pretty pass when FIFA criticise our performance.'

- 'I got calls from Italy last summer and one agent offered me Batistuta.

He told me "Batistuta wants to come to Chelsea." I said "I'm

sure he does, but we've stopped signing pensioners."'

- On being ousted from the board of Wembley National Stadium Limited:

'Even Jesus Christ only had one Pontius Pilate - I had a whole team

of them.'

- 'Take Ruud Gullit. I didn't like his arrogance. In fact, I never liked

him. But while he was delivering the goods, there was no problem. When

he lost the plot he had to go.'

- 'It takes one to know one. I'm surprised Martin O'Neill actually knows

a word as big as cretin.'

- 'I'm delighted for Claudio Ranieri that we beat Fulham in the FA Cup

semi-final, as if we'd lost yesterday, it would have been a pity to

sack him just after he'd signed a new contract!'

- 'All those toilet rolls coming on from Besiktas fans was orchestrated.

They wanted to get the kick-off delayed so they would know what the

other result was before our game finished. I said to Roman Abramovich,

"if you fancy making another billion, go and open another toilet

roll factory in Turkey."'

back to top

It was clear that, with the colourful Bates around, life for Leeds United

would never be dull, and there would be plenty of controversy along the

way. Opinion was sharply divided and there seemed to be as many people

saying that Bates would destroy the club as those who saw him as a refreshing

new broom, bringing with him heavy doses of reality and business acumen.

Shortly after the takeover, the Yorkshire Post carried a story

of a bid to derail Bates' plans. Simon Morris, the club's leading shareholder

before the deal, was offered an incentive of £250,000 by a rival consortium

to stall negotiations. Morris was offered the money just hours before

Bates formally took charge of United.

'The approach came from charity fundraiser Stuart Levin, who asked Morris

to "put a stop" on the Bates deal and offered to pay the money,

claiming a rival consortium's funds were just 24 hours away from being

available. The offer was dismissed, however, and Bates duly completed

his takeover in the early hours of January 21.

'Three consortiums were bidding for the club at the time - one led by

Bates, another by United season ticket holder Norman Stubbs and a third

mystery  group

on whose behalf Levin made the approach. The drama unfolded on Thursday,

January 20 when go-between Levin, in the offices of chartered accountants

Haines Watts, made the offer to United director Morris, who was in the

offices of the club's solicitors, Walker Morris.

group

on whose behalf Levin made the approach. The drama unfolded on Thursday,

January 20 when go-between Levin, in the offices of chartered accountants

Haines Watts, made the offer to United director Morris, who was in the

offices of the club's solicitors, Walker Morris.

'Levin asked: "What do you want to put a stop on it in the next

24-48 hours?" Later in the conversation, he offered to pay £250,000

using an American account, and then promised "we'll give it you in

writing now."

'Morris, who yesterday said he treated the offer light-heartedly, responded

by asking: "Can they make a cheque payable to my granddad?"

'Levin said yesterday: "It is true that I did, on behalf of the

consortium I represented, which consisted of die-hard Leeds United supporters

and businessmen, offer Simon Morris an incentive to hold back on any other

deal as I knew our funds were 24 hours away. He said he was very interested

and asked how the incentive would be paid. I said that upon completion

of our deal that he should provide a bona-fide invoice so everything would

be above board. I never heard from him again about this matter. Speaking

as a Leeds United supporter of 48 years standing, I think Ken Bates is

doing an excellent job and I wish him all the best."'

Morris said: 'I was being offered money to stop the deal with Ken Bates

going through. The only way I could treat it was light-heartedly and with

contempt. I was surprised by the nature of this when we were so close

to securing the future of the club.'

Melvyn Levi, a fellow director of Morris at Elland Road until Bates'

takeover, said there was no chance of the former Chelsea chairman's takeover

being halted. He told the Yorkshire Post: 'The offer was made in

an open meeting and the lawyers heard it. But we had met Ken Bates the

previous Monday and we were set to complete on the Friday - as far as

I am concerned, you cannot do any better than that. He had his lawyers

working through the night to get the deal done, that was a clear sign

of his intent, and there was no doubt he was the one who was going to

save Leeds United. We had stabilised the club and wanted someone to take

it forward. There was no way we would rely on someone saying "the

money will be here in 24 hours" - we had heard it all before. We

had had too many false dawns in the past, but it was clear Ken Bates was

not a false dawn. All these rich people in Leeds had had 10 months to

sort a deal - we had always said from the start that we would talk to

anyone who came along with a sensible offer to take over the club. Ken

did that and took the chairman's statement that all the figures were correct.'

It was a controversial story, but only in keeping with all the speculation

and innuendo that Elland Road had seen so much of over the previous couple

of years. Whatever the reality, one thing was clear: Bates had saved Leeds

United Football Club from oblivion and they could finally dare to hope

for a bright new future.

Part 1 - A nasty dose of reality - Part

3 - Dawning of a new era - Results and table

back to top

After

months of speculation it was confirmed on 19 March 2004, that insolvency

practitioner Gerald Krasner had negotiated a deal with the creditors of

Leeds United that allowed Adulant Force, the consortium he fronted, to

take control of the club and save it from the administration that had

seemed inevitable.

After

months of speculation it was confirmed on 19 March 2004, that insolvency

practitioner Gerald Krasner had negotiated a deal with the creditors of

Leeds United that allowed Adulant Force, the consortium he fronted, to

take control of the club and save it from the administration that had

seemed inevitable. takeover and keep the club afloat in seven months after saving it from

bankruptcy.

takeover and keep the club afloat in seven months after saving it from

bankruptcy. also

a clause to buy back the ground. That's at any point during the lease,

not necessarily at the end of it.'

also

a clause to buy back the ground. That's at any point during the lease,

not necessarily at the end of it.' options on the table and choose the best one for Leeds United.'

options on the table and choose the best one for Leeds United.' Sainsbury he would invest £10m in Sainsbury's consortium in exchange for

51 per cent of Leeds and the role of chairman.'

Sainsbury he would invest £10m in Sainsbury's consortium in exchange for

51 per cent of Leeds and the role of chairman.' There

were some welcoming words, however, from others. Peter Lorimer, whom Bates

asked to remain a director: 'The board did a great job knocking £80m off

the debts but now the club has to go forward and I'm sure Ken is the right

man. I'm sure he knows what is needed and what to do about the finances.

The team has been rebuilt and we are moving ahead.'

There

were some welcoming words, however, from others. Peter Lorimer, whom Bates

asked to remain a director: 'The board did a great job knocking £80m off

the debts but now the club has to go forward and I'm sure Ken is the right

man. I'm sure he knows what is needed and what to do about the finances.

The team has been rebuilt and we are moving ahead.' Leeds

United.

Leeds

United. group

on whose behalf Levin made the approach. The drama unfolded on Thursday,

January 20 when go-between Levin, in the offices of chartered accountants

Haines Watts, made the offer to United director Morris, who was in the

offices of the club's solicitors, Walker Morris.

group

on whose behalf Levin made the approach. The drama unfolded on Thursday,

January 20 when go-between Levin, in the offices of chartered accountants

Haines Watts, made the offer to United director Morris, who was in the

offices of the club's solicitors, Walker Morris.